Paycheck calculator new w4

Subtract the value of Withholding Allowances claimed for 2022 this is 4300. To change your tax withholding amount.

W 4 Form Basics Changes How To Fill One Out

Use your estimate to change your tax withholding amount on Form W-4.

. Or keep the same amount. Welcome to the W4 Calculator Get started filling out your Form W4. Simply enter their federal and state W-4 information as well as their.

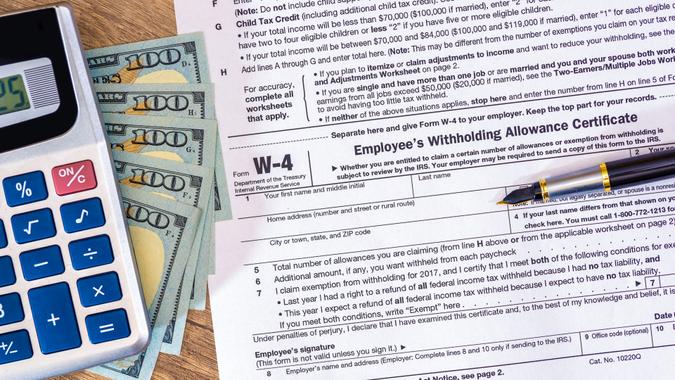

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your.

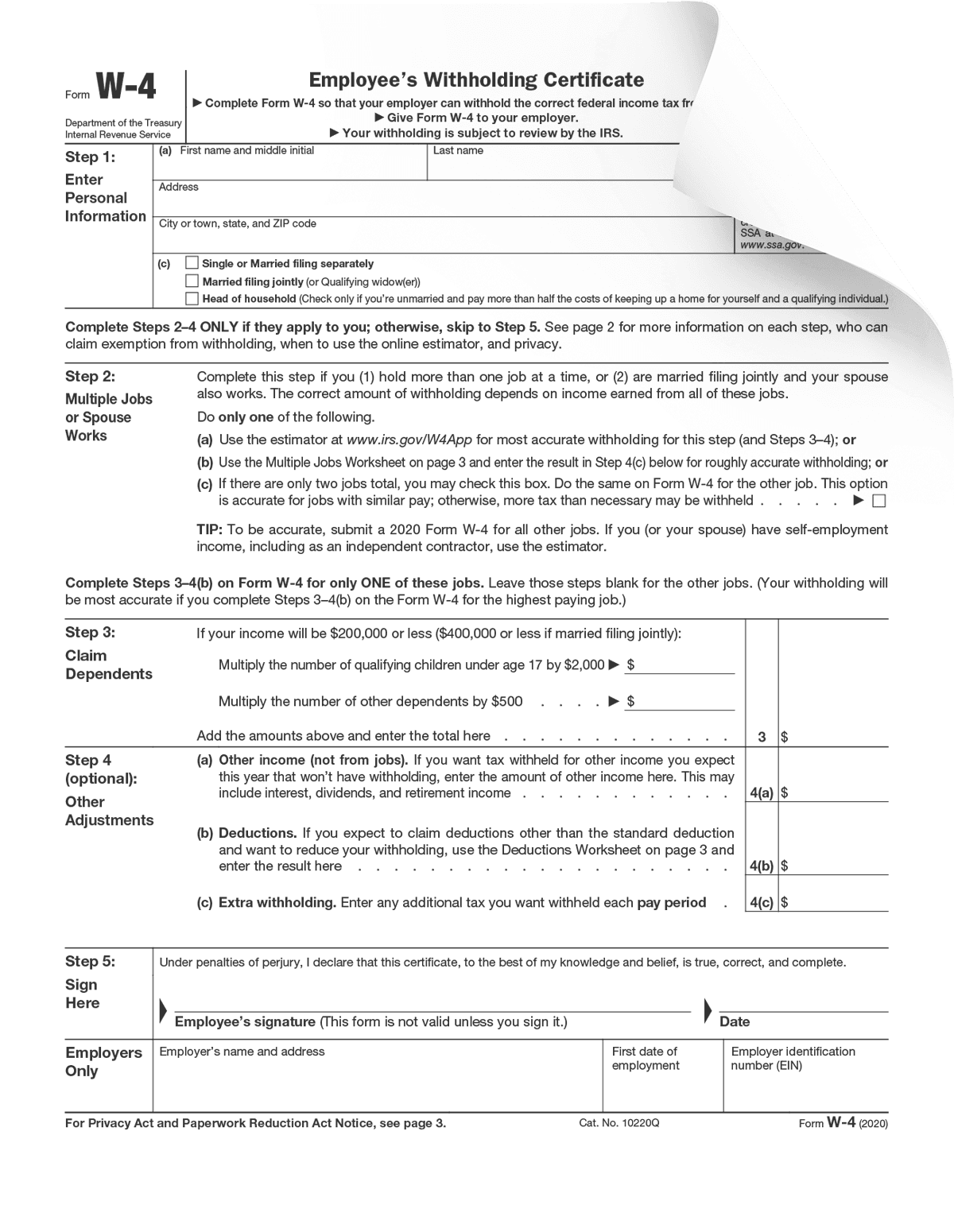

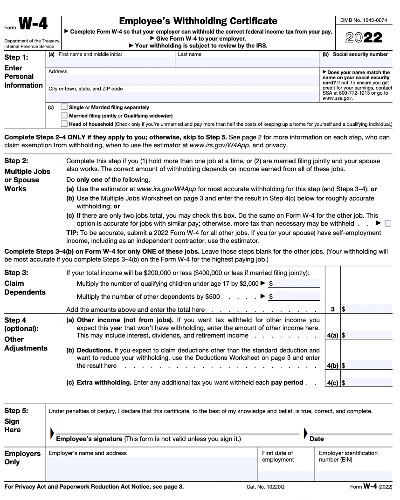

Just enter the wages tax withholdings and other information required. Discover ADP Payroll Benefits Insurance Time Talent HR More. The IRS issued a new Form W-4 in 2020.

Enter your new tax withholding. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The new design is simple accurate and gives employees privacy while minimizing the burden on employers and the payroll process.

Use our W-4 calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. This number is the gross pay per pay period.

Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Figure out which withholdings work best. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll. But calculating your weekly take-home.

How Your Paycheck Works. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Free Federal and New York Paycheck Withholding Calculator.

Allowances are marked on your. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck.

Plug in the amount of money youd like to take home. Salary Paycheck and Payroll Calculator. Financial advisors can also help with investing and financial planning - including.

Subtract any deductions and. Get the Paycheck Tools your competitors are already using - Start Now. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section P163 you will see your per paycheck tax withholding amount based on your selected pay. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. A financial advisor in New York can help you understand how taxes fit into your overall financial goals.

Use the results from the Withholding Calculator to determine if you should complete a new Form W-4 and if so what information to put on a new Form W-4. Calculating paychecks and need some help. Well guide you through a few quick questions and provide you with a completed Form W4 that is ready for printing.

New Jersey Salary Paycheck Calculator. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Federal And State W 4 Rules

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Online Broker

5 Steps To Stop Living Paycheck To Paycheck Paycheck Learning Wealth Building

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

Calculate Or Compare 2019 Or 2020 W 4 Results With The Multi State Calculator

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

W4 Tax Form 2022 With Calculations W 4 Tax Form How To Fill Out W4 Tax Form 2022 Youtube

W 4 Form What It Is How To Fill It Out Nerdwallet

Form W 4 Form Pros

The Financial Planning Flowchart Financial Planning Flow Chart Financial

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Completing A W4 New Employee Orientation

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

A New Form W 4 For 2020 Alloy Silverstein

Paycheck Tax Withholding Calculator For W 4 Tax Planning

What Is A W 4 Form How It Works Helping Your Employees Complete It

How To Fill Out A W 4 A Complete Guide Gobankingrates